New mobility models: The innovations fulfilling today’s consumer expectations

In an era where customer experience is a priority, the automotive industry is seeing the emergence of multiple forms of mobility that offer consumers a broader range of travel options. Businesses are responding to the consumer need for greater diversity and choice in mobility by providing flexible offerings that cater to individuals’ lifestyles. These models fall into categories that include the privately owned or leased- vehicle model, community-based schemes in which a fixed group of people shares a vehicle, or other transport-sharing options that range from public transport to private and consumer-to-consumer rental. But the financial viability and overall success of these new models is dependent on multiple factors, from utilization of the service to the customer’s income, geographical location, and age.

“Numerous industry innovations are supporting the development of mobility models and will help these initiatives to become more sustainable over time, but the investment needed to set them up can be challenging.”

The appeal of shared mobility

For many consumers, especially the younger, lower income driver, the traditional private-ownership model has become less appealing. A car is an expensive purchase that sits unused for up to 95% of the time. Rental cars and taxis can be expensive, and public transport involves long waiting times and the additional travel to bus stops or train stations.

Consequently, businesses are devising new concepts that offer by-the-minute mobility opportunities. Options like SnappCar, for example, which enable vehicle owners to rent their cars to other people, are becoming more popular. These models offer affordable alternatives to private rental companies and appeal to consumers with their environmental ethos; fewer vehicle owners mean fewer cars on the road. They also offer the benefits of a private vehicle without the cost. Sharing models are breaking new ground in offering solutions to consumers who want to get from A to B but who aren’t concerned about what vehicle they use for the journey.

Higher income consumers have more exclusive options at their disposal. Porsche Drive, for example, is a short-term subscription model that gives drivers the opportunity to collect and drive any Porsche vehicle whenever they want, while SHARE NOW or GreenMobility allow drivers to access and use vehicles in free-floating, car-sharing schemes. Customers can book a vehicle for any length of time and then leave it in a parking space within a designated area when they’re finished with it.

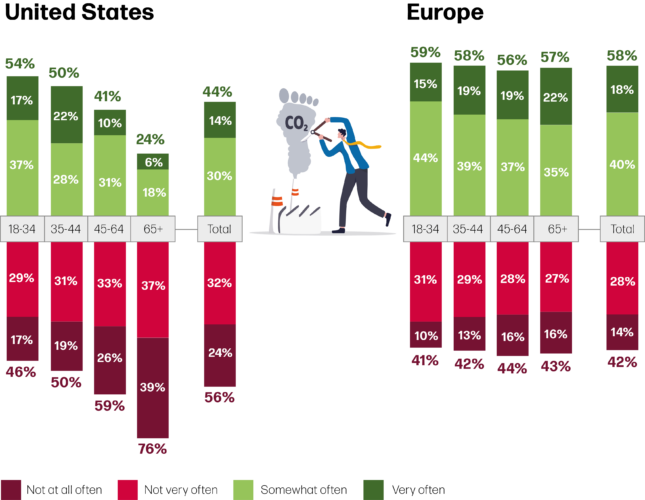

How often do you consider your carbon footprint when selecting daily transportation?

Source: MSX Analysis

IBM Sustainable Mobility Consumer Survey; USA cities were Chicago (n=930) and San Francisco (n=950); European cities were Rome (n=940), London (n=960), and Munich (n=980)

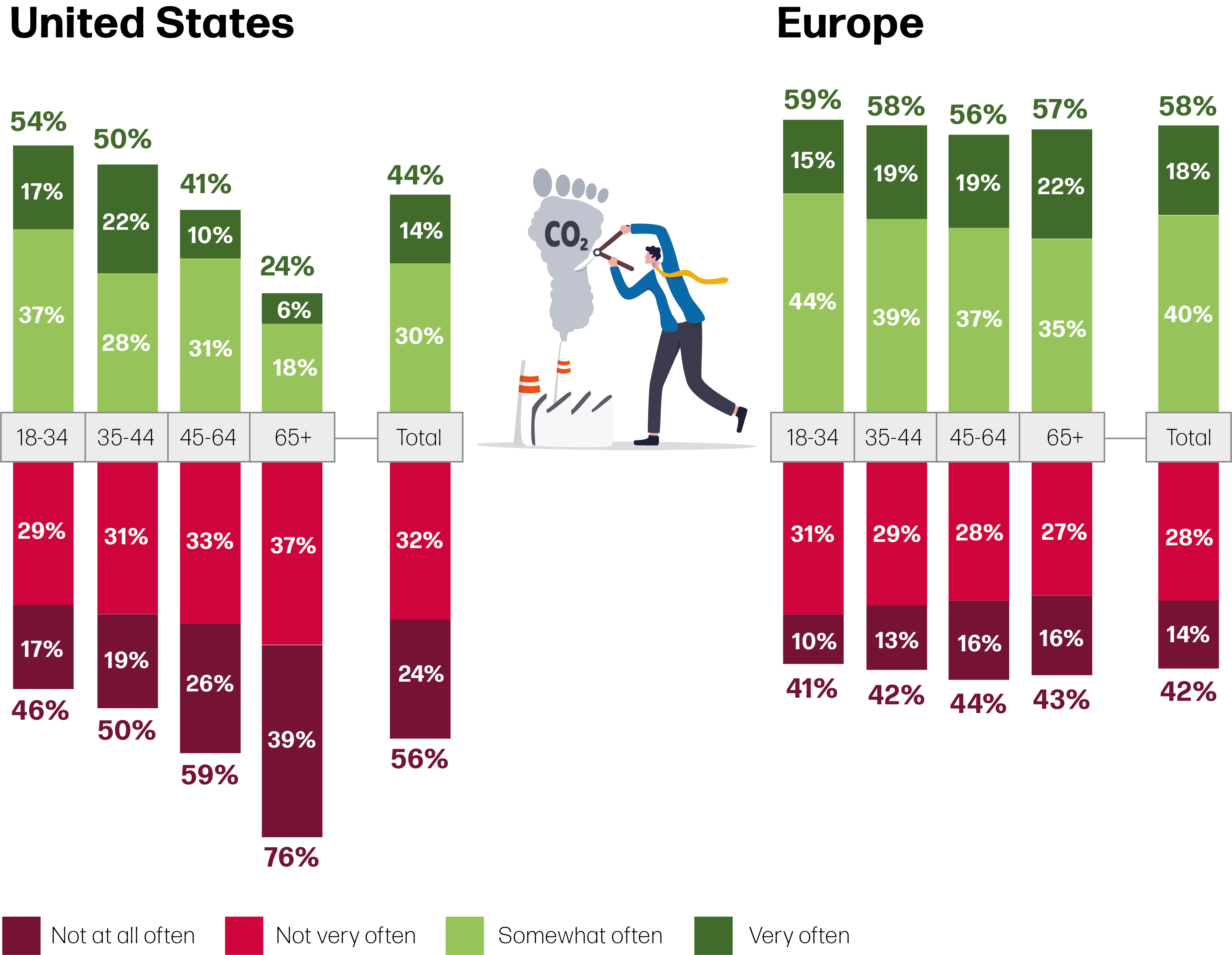

How often do you consider your carbon footprint when selecting daily transportation?

Source: MSX Analysis

IBM Sustainable Mobility Consumer Survey; USA cities were Chicago (n=930) and San Francisco (n=950); European cities were Rome (n=940), London (n=960), and Munich (n=980)

The emergence of driving communities

A more environmentally conscious consumer is also inspiring another mobility model – the driving community, whereby a group of people owns and shares a single vehicle. People in driving communities are less interested in owning their own vehicle, and organizations such as Lynk & Co are tapping into this market.

Lynk & Co profiles itself as a mobility brand and produces a vehicle that paying members can share within a small, fixed community, with benefits such as maintenance and insurance included. This concept also offers the consumer the option of free membership in return for a fee when a car is used. Models such as this work for individuals who prefer a private driving experience, while rules and boundaries within the community ensure the vehicle is clean, well looked after and not overused by any member.

The viability of mobility innovation

Numerous industry innovations are supporting the development of mobility models and will help these initiatives to become more sustainable over time, but the investment needed to set them up can be challenging. For example, by using electric vehicles for shared schemes, their simplified engineering will cut the need for maintenance, increase uptime, and reduce cost per mile, but currently, the costs involved in managing the infrastructure are high.

Autonomous vehicles can also revolutionize the shared mobility space; the driverless vehicle is already being trialed in some markets for minute-by-minute customer rental. Autonomous driving technology development company Waymo offers an autonomous ride-hailing service in Phoenix, Arizona, and expanded its testing to San Francisco earlier this year. But the cost of technology needed to roll out and support such a concept is high.

The costs of autonomous technology must be spread out over many vehicles to even it out, so getting a profitable business model running in these areas will rely on the availability of fast, affordable, and efficient services. If the shared mobility model can match the likes of Uber’s waiting times and improve on public transport in terms of cost, its demand will grow.

It’s hard to predict which models will be most successful, but over time, customer adoption will improve as more concepts emerge. Software too is becoming more innovative, inspiring further developments by startups or other disruptors, opening up the competition and driving down costs to the consumer.

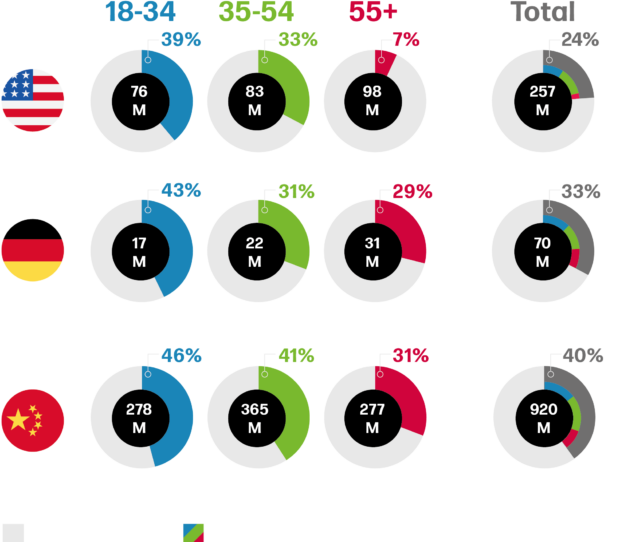

My future mobility needs will be met by:

Source: MSX Analysis

Data Sources: Deloitte 2022 Global Automotive Consumer Study, Statista – Resident population of the United States by sex and age as of July 1, 2020, Federal Statistical Office of Germany (Reference date December 31, 2020), National Bureau of Statistics of China – China Statistical Yearbook 2019 – Population by Age and Sex (2018)

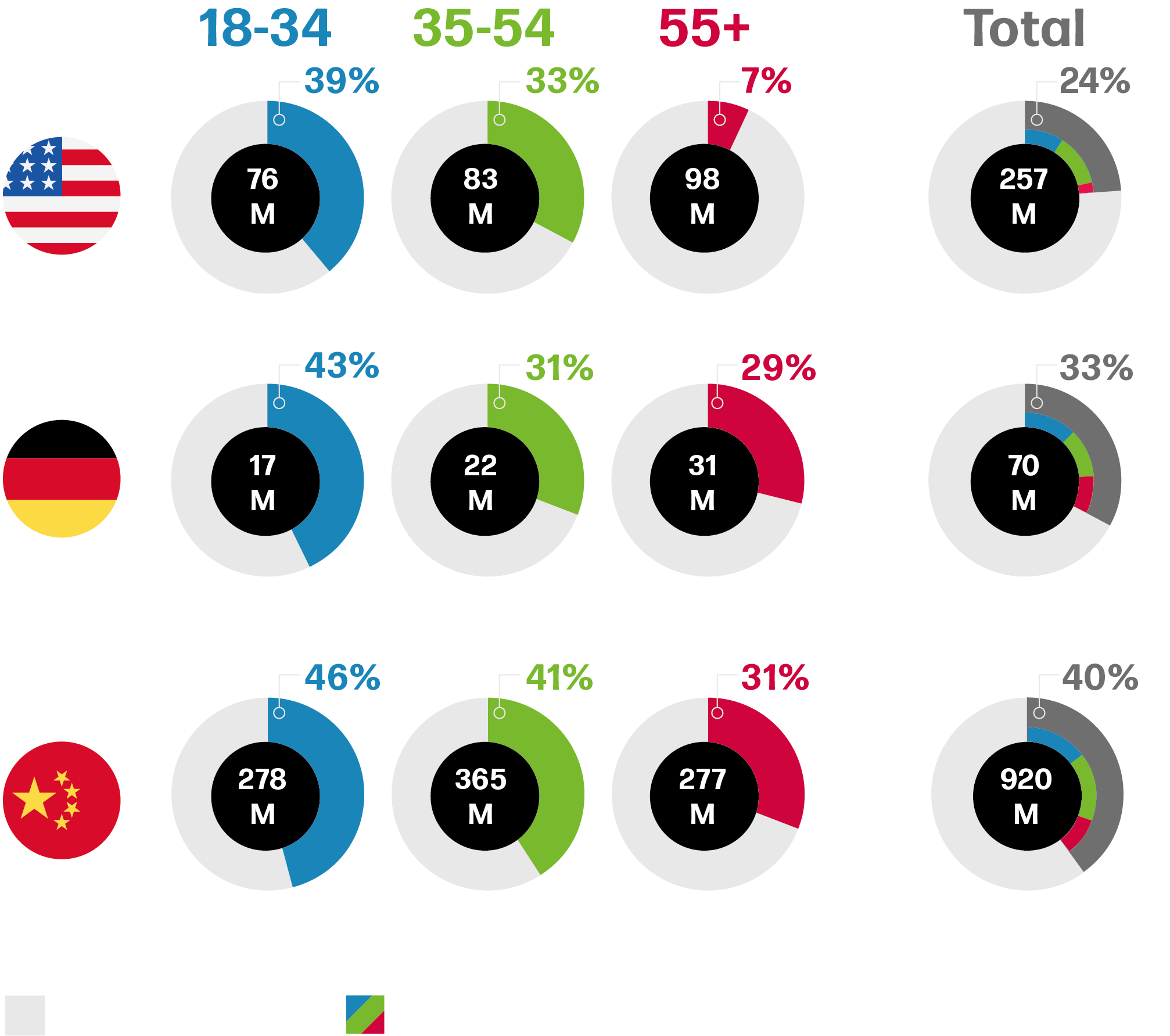

My future mobility needs will be met by:

Source: MSX Analysis

Data Sources: Deloitte 2022 Global Automotive Consumer Study, Statista – Resident population of the United States by sex and age as of July 1, 2020, Federal Statistical Office of Germany (Reference date December 31, 2020), National Bureau of Statistics of China – China Statistical Yearbook 2019 – Population by Age and Sex (2018)

Making mobility models profitable

Mobility models such as these are still relatively new, and some organizations in this space are helping to bolster profits by setting up more lucrative offerings. Lynk & Co, for example, offers customers an option to buy its unique Lynk & Co 01 vehicle with cash or financing.

Most importantly, the success of a business model depends on utilization. A model that enables a user to drive a vehicle to a destination and leave it there is a huge logistical challenge. It takes a lot of effort and logistics to collect, clean and, if needed, recharge that vehicle so it’s ready for the next customer. The business must also ensure there are enough vehicles in operation to generate profit. The consumer’s location also contributes to utilization. Currently, shared models are more feasible in urban areas, where population density ensures services are in constant operation, but they’re harder to operate in rural areas where there’s less demand.

Meanwhile, it’s difficult to predict when enough customers will adopt these models and enable them to expand into larger-scale operations. For consumers to convert from vehicle owners to vehicle sharers is not only income and cost-dependent, but a huge mindset change – the vehicle they drive will no longer be theirs. The benefits of alternative models must outweigh those offered by the private vehicle parked conveniently outside their homes.

The needs of individual consumers will also change throughout their lives. Mobility models may be suited to younger generations but as they grow older, some will move to rural locations, some will have children, or their lifestyles will change in other ways, so shared mobility models may become less appealing. The industry will need to find ways to make these business models more profitable, more sustainable, and more interesting to a wider audience.

There will always be risks in launching a mobility operation, especially at a time when the cost of private mobility is still relatively low. However, oil is an unsustainable commodity, and fuel costs are increasing. Consumers’ attitudes to vehicle ownership are also changing rapidly as they become more accustomed to the use of other shared ownership models and subscription services, adopt more virtual services, and demand greater flexibility in their lives. Ultimately, the need for alternative mobility solutions, from a financial, social, and environmental perspective, will almost certainly justify the emergence of innovative new models into the market.

About the Author:

Xavier Vandame

Vice President, Sales – Asia Pacific, Middle East and Africa

Xavier is currently based in Australia and responsible for all sales activities across Asia Pacific, Middle East and Africa. During his 26 years at MSX, Xavier has worked in many diverse markets in Europe, North America and Asia Pacific where he has gained extensive experience in all aspects of automotive dealer retail and wholesale activities. He can be reached at xvandame@msxi.com.