A fleet management revolution: Market growth inspires ambitious change

Fleet businesses are growing rapidly across the globe. An increase in the popularity of private leasing, online shopping, and mobility-on-demand services mean the share of fleet cars now accounts for a far greater proportion of vehicles on the road. In response, automotive organizations are investing in fleet management operations to help enhance the complex process of in-fleeting, de-fleeting and remarketing vehicles in an increasingly competitive industry .

According to MarketsandMarkets the global fleet management market could grow from $20.6 billion in 2021 to $33.9 billion by 2026. This growth, and the supply-chain restrictions of the past two years, have inspired leasing companies, OEMs, and large dealer groups to become more ambitious and expand into new business areas. It’s a revolutionary change for the industry. Rather than specialize in the needs of a particular fleet size or operational type, many businesses are now exploring more profitable or risk-averse strategies delivering rental vehicles for the short, medium, or long-term to both private and professional customers.

Some leasing companies are now managing the entire operation independently. They handle everything from in-fleet processes and ongoing servicing of the car parc, to de-fleet processes and vehicle refurbishment and resale, complete with financing and insurance policies. They are making their operations more comprehensive, profitable, and easier to control, and they’re taking ownership of the full, end-user relationship. Consequently, they have greater potential to lure business away from the OEM networks.

“Recent industry changes such as the agency model trend are forcing OEMs and their dealer networks to rethink their fleet and remarketing strategies, adapt to new fleet opportunities, and pay close attention to these competitors moving into the field.”

– Eric Menoret

Market dynamics are shifting as businesses step up their fleet strategies

Recent industry changes such as the agency model trend are forcing OEMs and their dealer networks to rethink their fleet and remarketing strategies, adapt to new fleet opportunities, and pay close attention to these competitors moving into the field. Traditionally, they have focused on supplying vehicles to rental companies. But now, OEMs and their dealer networks are shifting away from these private, short-term arrangements and competing directly with fleet management or operational car leasing companies for the longer-term lease market, serving both private customers and B2B operations, such as suppliers of company cars.

They’re also finding ways to keep customers loyal to the network by setting up end-to-end fleet and remarketing operations that exclude the need for the intervention of external organizations in the process. These fleet operations include the distribution of vehicles, insurance packages, remarketing and vehicle resale, as well servicing activities throughout the contract duration and post-sale.

Some manufacturers also provide financial services or ‘captive lease’ solutions, while others are partnering with large financial organizations to strengthen their offerings. Stellantis, for example, has recently announced a joint venture with Crédit Agricole Consumer Finance (CACF) to deliver enhanced leasing agreements to its European customers. Big dealer groups are also stepping into this domain. Emil Frey – one of Europe’s largest dealer groups – comprises many established dealerships from across Europe. The organization, which brands itself a mobility service provider, offers its own captive lease program to customers of any type, as well as centralized management of fleet services across brands.

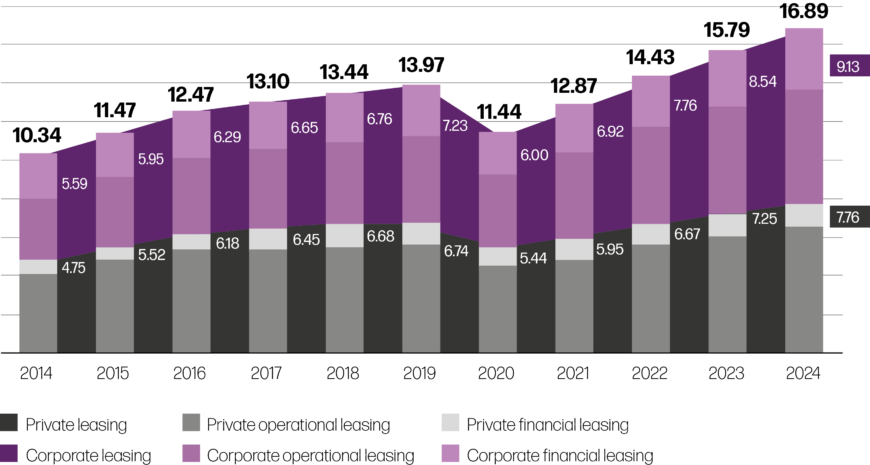

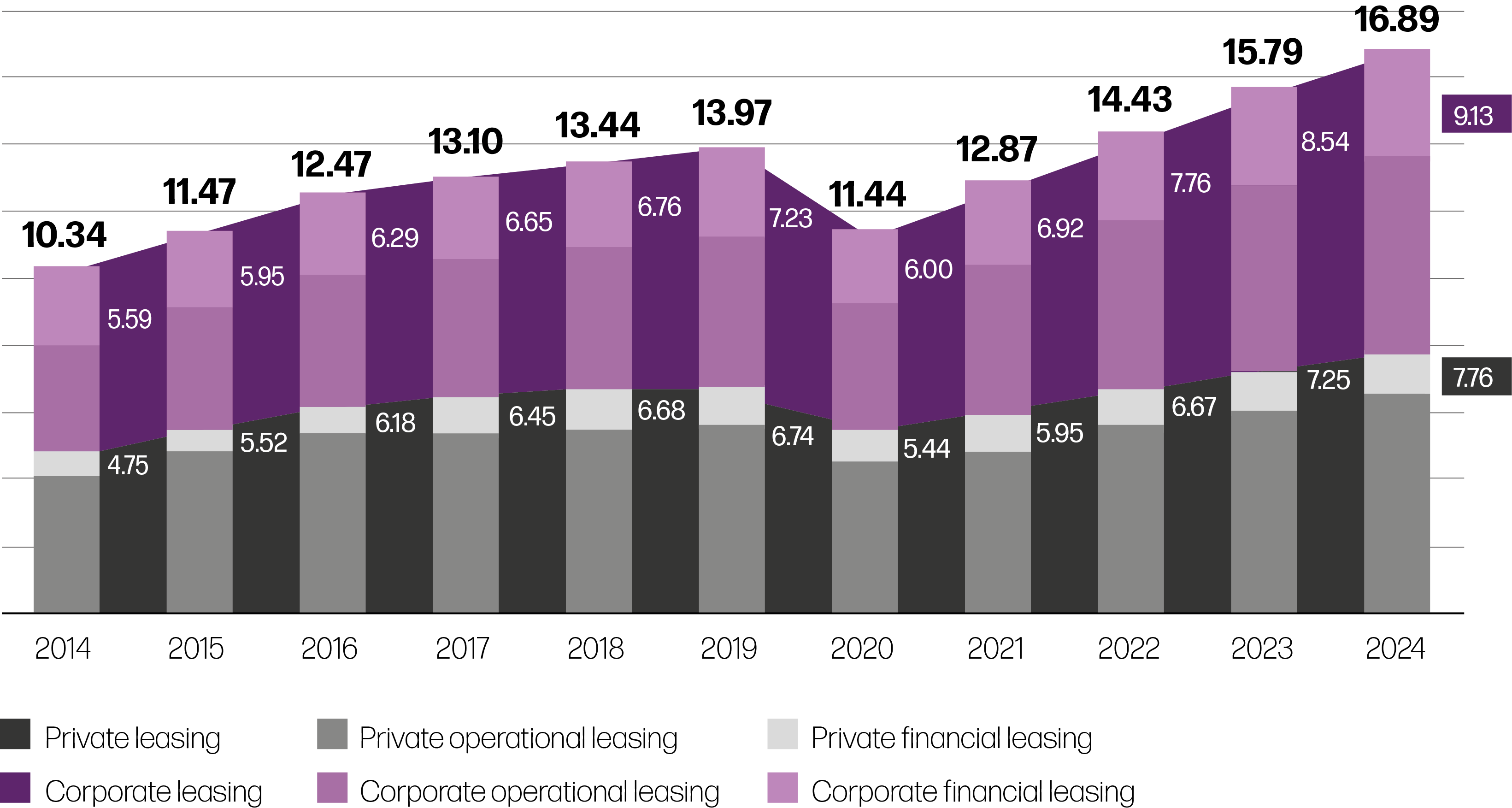

Global vehicle leasing market

(Million vehicle registrations)

Source: Frost & Sullivan

Global Vehicle Leasing Market

(Million vehicle registrations)

Source: Frost & Sullivan

As brands transition from vehicle producer to mobility provider, their leasing-customer base grows, and so does the volume of vehicles in the remarketing pipeline. With the right fleet remarketing tools in place, they can turn over the increased volume of cars profitably. Some are supporting the process by running certified, pre-owned programs (CPOs) which provide multi-point inspections to build customer trust, and by setting up user-friendly digital platforms through which customers can buy or lease used cars.

“Brand expansion in the fleet and remarketing sector is mandatory for businesses in terms of customer experience and revenue opportunities, but the complexity of more stakeholders and a broader customer base must be carefully managed.”

– Pedro Garcia

Brand expansion in the fleet and remarketing sector is mandatory for businesses in terms of customer experience and revenue opportunities, but the complexity of more stakeholders and a broader customer base must be carefully managed. Fleet operations need to be lean and flexible to minimize the lead time on every element in the process, from a vehicle’s delivery into a fleet, to its resale. This will be vital as EVs enter the market in greater numbers. Analysis from Autovista Group, based on data for Germany, suggests that for some vehicle segments the residual value performance of battery electric vehicles (BEVs) falls more steeply than their ICE competitors. Furthermore, model lifecycle depreciation effects may continue to be stronger for BEVs than ICE vehicles in the coming years as vehicle range increases with new model generations. Highly effective remarketing processes will almost certainly be necessary in generating profit from their resale.

Trends impacting the vehicle leasing market

Source: MSX International

Trends impacting the vehicle leasing market

Source: MSX International

Streamlined fleet management solutions provide necessary support

Fleet management is a valuable automotive segment globally, but in Europe, it has accelerated into a multi-billion-euro sales channel. Traditionally, independent fleet management companies have dominated the market, but now many OEMs are expanding their fleet practices to supply highly sophisticated and competitive offerings. This has led to a rapid increase in flexible mobility solutions such as shared vehicle assets or vehicle leasing.

But to meet these evolving needs, businesses must consolidate their fleet management processes to manage the multiple layers of activity, from in-fleet processes to de-fleet, remarketing and used-car sales complete with financial, servicing and affinity packages. They must also align the interactions between suppliers, of which there are many. They can include transportation or logistics companies, service networks, refurbishment specialists, remarketing websites and appraisal organizations, as well as used car sales channels, such as dealer networks, used car specialists, used car brokers and auctioneers.

MSX Fleet Monitor is supported by web-based digital tools that connect your systems with those of your fleet management suppliers. This agile solution works at global, national, or regional levels to help fleet managers analyze and control stock, accelerate lead times, diversify the customer base, and boost resale prices.

The integration between these businesses is traditionally fragmented, but can now be fully streamlined, maximizing the flow of data from one to the next, and giving fleet managers full control of fleet management processes. Meanwhile, specialist remarketing tools and processes are critical to prevent hold ups at any stage, which otherwise would have led to remarketing waste, accelerated depreciation of the vehicle and the immobilization of cash for days on end.

Consequently, forward-thinking OEMs are moving away from unreliable fleet methodologies in favor of verticalized, digital solutions that integrate multiple technology platforms, including those of all external suppliers. Comprehensive workflow solutions can handle all additional complexities through a single web-based platform, helping the business capture data across every process, enhance transparency, optimize profit, and improve lead times across channels and borders. Ultimately, with the right tools, OEMs can deliver the highest standard of fleet operations and compete effectively against established leasing companies, while giving customers multiple reasons to stay loyal to the brand.

About the Authors:

Eric Menoret

Vice President and Global Account Executive

Eric Menoret is Vice President and Global Account Executive at MSX International. He is responsible for managing the company’s growth strategy and sales finances, and ensuring the team delivers a high level of satisfaction to OEM accounts at global, regional and local levels. He is also part of the MSX global Fleet and Remarketing task force, responsible for addressing the growth of this key area of the market. Eric can be reached at emenoret@msxi.com.

Pedro Garcia

Global Director, Fleet and Remarketing, Mobility Solutions

Pedro joined MSX in October 2018 and is responsible for the development of end-to-end digital solutions that aid OEMs in the sale of vehicles to large and medium fleets. The role includes the maintenance of processes and relationships between manufacturers and fleet companies throughout the remarketing process. Pedro has more than 20 years’ experience in the automotive industry, which includes senior positions within PSA Peugeot, Daimler and VW Group. Pedro can be reached at pgarcia2@msxint.com.