Explore how we see the future of automotive

Stay updated. Be informed.

Sign up to receive our latest editions of the Global Benchmarker, containing industry insights on the latest automotive megatrends.

Andrea Sorrenti

Chief Operating Officer

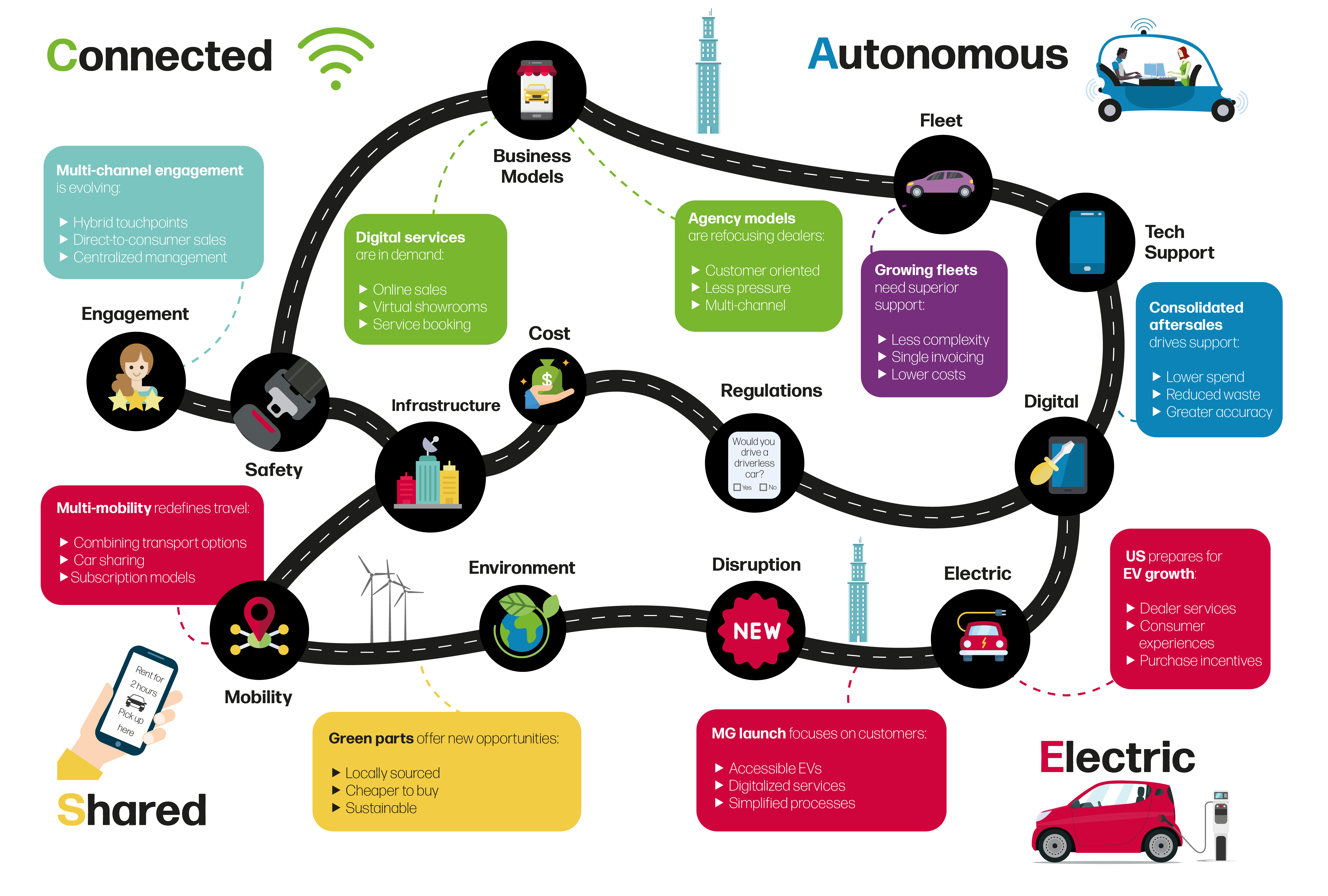

Change drives innovation, and the transformation in consumer behavior and expectations, accelerated by the pandemic, has been monumental. Consumers are now looking for convenient, clean and more sustainable mobility solutions. They live in a digital, on-demand world and it’s crucial that the automotive industry adapts to meet their needs and anticipates what comes next. The industry’s response is the development of connected, autonomous, shared mobility and electric (CASE) strategies, which will affect all automotive players and influence the way consumers interact with mobility.

Pieter van Rosmalen

Chief Strategy Officer

The constant evolution and disruption of the automotive industry has left manufacturers and industry players struggling to plan for the scale of transformation their business models need to undergo. Technological advances in recent years have driven new mobility service models, redefining the competitive landscape of the automotive industry. While connected services, autonomous vehicles, shared mobility and electrification technologies (CASE) are progressing at different rates, and with varying degrees of adoption, they are all having a dramatic impact on the global automotive industry.

Shawn Coyle

Vice President and Global Account Executive

Dealerships in the US are facing extensive change as the growth of the electric vehicle (EV) market puts pressure on sales and service models. In this article, Shawn Coyle, Vice President and Global Account Executive, MSX, explores how automotive manufacturers and their retail networks can manage the necessary adjustments to their operations while upholding the traditional, community-led values of the true American dealership.

Rob van Rijswijk

Vice President of Business Development and Strategy

The concept of mobility is evolving. Economic and environmental concerns are forcing people to rethink the way they travel, whether they live in cities or rural areas. Mobility is currently very one dimensional, with people often relying on a single device – a car, a bike, or a train – to move around. Greater flexibility in transport offerings allows commuters to complete their journey more quickly and efficiently. Multi-mobility or flexi-mobility are terms that describe the concept of combining multiple transport options in a single journey, offering customers a more economical and environmentally friendly way to travel.

Emiliano Nebbioso

Vice President Business Solutions, Europe

Across the automotive industry, manufacturers are replacing their generations-old, supply-driven wholesale models with business strategies that are led by consumer demand. The agency model is already being pursued by several brands which are facing the necessary cultural changes head on. This model, whereby dealers act on behalf of the OEM but don’t own stock or set prices and deals, means manufacturers and their networks must adapt their attitudes and operations to make it work.

Daglef Seeck

Aftersales Director, D-A-CH at MG Motor, Germany

MG has relaunched in mainland Europe with a renewed commitment to making electric vehicles accessible to more drivers, and the organization already has more than 100 operational brand stores. In this interview, Daglef Seeck, Aftersales Director, DACH, MG Motor, Germany, discusses the future of the industry and how MG is going above and beyond to exceed customers’ expectations in this new era of automotive retail.

Andrew Mills

Director, Parts and Service

The subject of green parts – official OE parts that have been removed from a vehicle to be recycled or reused – has become increasingly topical for OEMs in recent months. Manufacturers are keen to understand emerging trends surrounding green parts and the future impact they’ll have on their businesses. The COVID-19 crisis and subsequent reductions in the need for maintenance and repair have led directly to a loss of parts sales revenue which OEMs are eager to replace, prompting significant parts price increases in the last 12 months.

Dirk Bott

Vice President, Global Sales Operations

To meet consumer demand, many manufacturers are adapting their retail businesses, introducing alternative sales models and digitalizing customer-facing and in-house processes. Although these digitalization efforts have been available for some time, the recent COVID-19 pandemic has accelerated the demand for online services, both from a consumer perspective and from an operational one.

Markus Klaus Rücker

Operations Director, D-A-CH

EVs entered the market later in Germany than in some of its European neighbors, such as Norway and the Netherlands. However, while overall vehicle sales dropped by 19% between 2019 and 2020, EV penetration soared from 2.9% to 12.8%. In this article, Markus Klaus Rücker, Operations Director Germany, MSX, discusses the current market conditions in Germany and how manufacturers are evolving their businesses in response to the emergence of new mobility models and consumer trends.

Eric Menoret

Vice President and Global Account Executive

Technical assistance, an essential service offered by OEMs, provides authorized repairers with support for complex and undocumented repairs. The increase in electrification and vehicle connectivity has heightened the complexity of vehicle maintenance and warranty management, putting further pressure on technical assistance staff to respond accurately and efficiently.

Felix Serrano

Vice President, Europe

Customer engagement methods are likely to change, as many steps in the automotive retail chain move online. Digital acceleration in the new reality has altered customers’ expectations in terms of the speed, transparency, and seamlessness of service they’ve come to expect as they move between online and offline ‘brick-and-mortar’ retail.

Christophe Bertocini

Operations Director, France

With France’s manufacturers producing around 10 million passenger cars annually worldwide, the country supports one of the largest automotive markets. But how are its industry-leading brands adapting to new powertrains, digitalization and the changing needs of the consumer? In this interview, Christophe Bertoncini, Operations Director, France, MSX International, discusses the transformation in this market, and how businesses are facing the challenges ahead.

Pieter van Rosmalen

Chief Strategy Officer

The relationship between a manufacturer and a fleet business can be, in traditional circumstances, a disjointed one. By the time its vehicles are sold or leased to a fleet business, an OEM has little knowledge of vehicles’ intended use, the distances they are travelling, how often they need servicing and where this maintenance work is being carried out. Only the franchised dealer networks that carry out service and repairs have insight into the operations of many of these fleets.

GLOBAL EDITION

Benchmarker

Thanks for reading our December 2021 Issue!

Editorial Team

Publisher: Pieter van Rosmalen, Chief Product Officer, pvanrosmalen@msxi-euro.com

Chief Editor: Jochen Schultze

Copywriting: Caroline Wiseman, Marsha Moore

Layout and Design: Julia Müller

Research: Ana Santos, Jade Murrell

Published by MSX International

Previous Editions:

Transforming automotive retail for the new reality

How will EVs shape our industry’s future?

Beyond Digital.

Forward Thinking Insights