Table of contents

Editorials

Articles

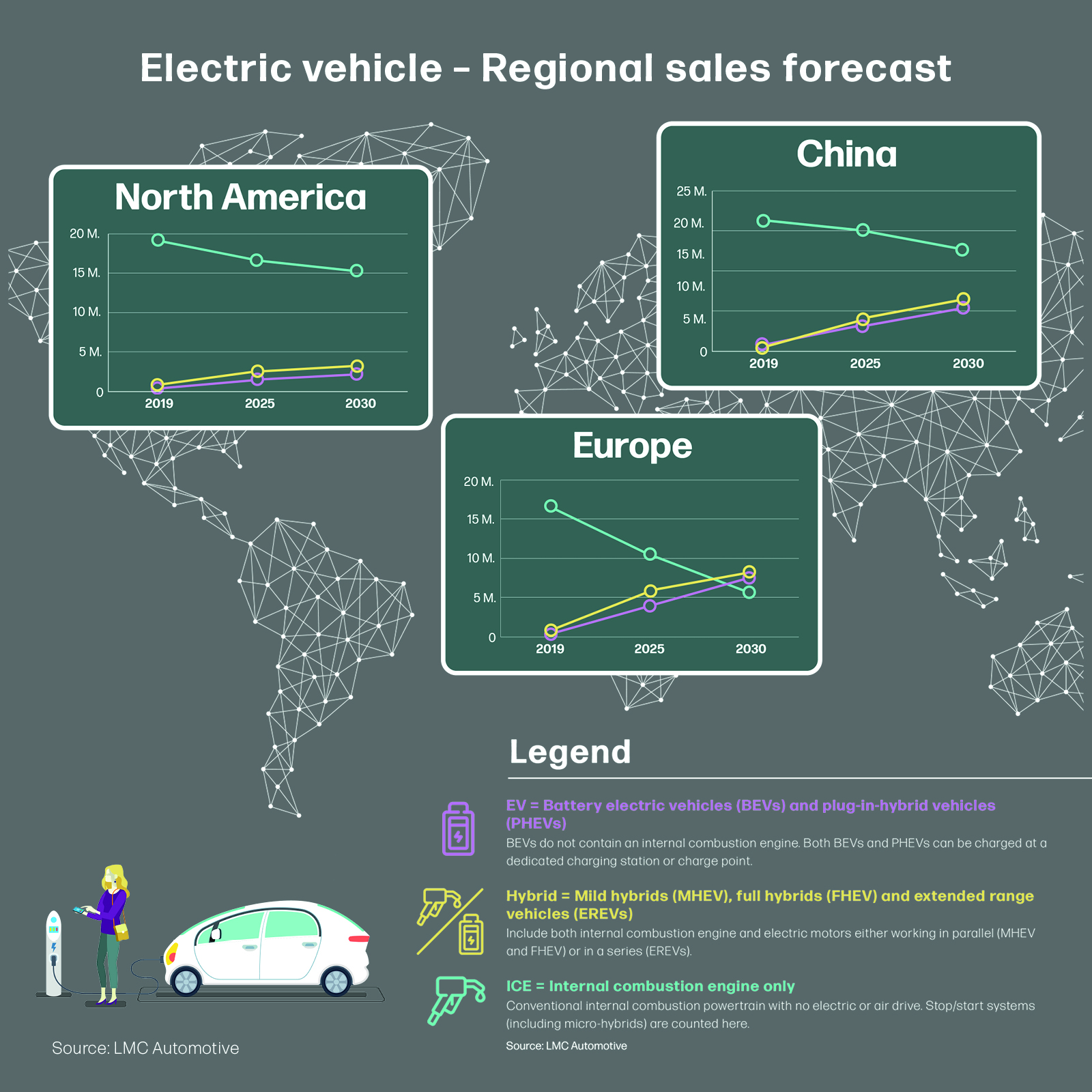

Electric vehicles are changing the automotive world as we know it

Prepare for the future of warranty management

Commercial training is essential for effectively selling EVs

Can OEMs endure the effects of EVs on their parts business?

Selling e-mobility: How can retail networks prepare?

New touchpoints – digitalizing the automotive customer journey

Stay updated. Be informed.

Sign up to receive our latest editions of the Global Benchmarker, containing industry insights on the latest automotive mega trends.

Patrick Katenkamp

CEO

OEMs face an unprecedented challenge in 2020. The COVID-19 outbreak demands precautions and social distancing which will deeply affect the automotive industry. Our global customers are experiencing difficulties that influence their daily operations as well as their long-term business strategies.

However, in a recent study by MSX Research regarding consumer behavior during the COVID-19 outbreak, 50% of respondents said they would still service their vehicle if it was due. Similarly, 41% said they would still consider buying a new vehicle despite the outbreak, proving that manufacturers still have a responsibility to deliver a positive service to their customers.

Pieter van Rosmalen

Chief Product Officer

In 2020, electric vehicles (EVs) are mainstream, thanks to the likes of Tesla and Nissan, and with environmental concerns at the forefront of people’s minds, they’re here to stay. The protection of air quality and reduction in greenhouse gas emissions is a priority for many global government bodies. As a result, emission reduction targets are placing pressure on manufacturers to speed up their responses.

The European Union, for example, introduced legislation in 2008 that dictated the need for manufacturers to reduce their emissions by 80 g/km by 2020. Today, many OEMs are facing fines for failing to achieve these targets. As a result, some manufacturers have introduced bonus schemes for their dealers as incentives to sell more EVs and help them avoid these fines.

#msxpodcasts

Episode: Supercharging the Aftersales Business with Digitization

Mikael Wespalainen

Global Director, Warranty and Technical Products

Electrification is changing the automotive industry at pace, and with that comes added complexity in how OEMs manage their warranty processes. Pure electric vehicles (EVs) are relatively simple compared to vehicles with internal combustion engines (ICE). Many components that can cause faults aren’t present, meaning that EVs should generate fewer warranty claims.

However, in the transition to a more eco-friendly way of driving, it’s expected that the industry will see a significant increase in the number of electric propulsion technology vehicles, including hybrids, plug-in hybrids and fuel-cell operated EVs. This will increase the complexity of warranty management significantly. For this period, OEMs could expect to see an increase in the number of warranty claims being handled.

Lois Valente

Director of Training, North America

While more and more consumers have started thinking about buying an EV, the industry is still finding it difficult to convince people to make the leap towards EV-ownership. Research carried out by McKinsey & Co demonstrates that improving dealer sales techniques is critical if OEMs are to meet their sales targets.

But there’s still a lot of work to do. McKinsey’s 2019 EV mystery shopping survey revealed product knowledge is still lacking – many dealers across regions could list only a single EV benefit from the broad spectrum of possibilities available. And dealer knowledge about total cost of EV ownership in some markets lacked detail on key maintenance-related questions, such as battery life and charging.

#msxpodcasts

Episode: Modern frontline learning for the

“new normal”

Andy Mills

Director, Parts and Service

The automotive industry is unquestionably anxious about the transition to electric vehicles (EVs), especially because of its impact on manufacturers’ highly lucrative parts businesses. EVs have fewer mechanical parts to repair or service, so OEMs are bracing for a considerable loss in revenue. While there are some new components, such as plugs and sockets, inverters and powerpack coolers, that don’t appear on conventional cars, profits from parts and routine maintenance are still expected to suffer. MSX research suggests the value of ordinary service maintenance and parts repair will fall by around 60% with EVs compared to traditional internal combustion engines (ICEs).

It’s a very different process to repair an EV than it is to repair an ICE vehicle, and this is a major challenge for OEMs and their dealerships. The cost to produce an EV is already significantly higher, and the battery is a major part of that – in some instances, the battery can cost in the region of $30,000. In the case of the Jaguar I-PACE, for example, that amounts to 45% of the price of the car. The battery is not just costly to replace if damaged, but also heavy, with some models weighing 600kg. This means more secure and robust support systems will need to be implemented, not just within the vehicles themselves, but at the repair centers that maintain them.

#msxpodcasts

Episode: Recovery from COVID-19 :

Impact on parts sales revenue

Dirk Bott

Vice President, Global Sales Operation

The automotive industry has prepared for considerable change for some years, but 2020 marks the beginning of a new era. Stricter CO2 regulations mean manufacturers must adapt their sales and aftersales processes to meet electrical vehicle (EV) requirements and respond to the evolving expectations of business customers and consumers.

Information reported by the media, retail networks and dealers, reveals that subjective ideas and myths continue to surround EVs. These are affecting manufacturers’ responses and impeding the implementation of clear, coherent sales processes.

It’s imperative to understand the concerns of consumers which are rarely based on personal experience. Opinions vary from one market to the next, but in Germany, it’s thought that most consumers see EVs as too expensive, that they take too long to charge, their coverage is too small, and that the batteries pose a serious problem. If retail networks don’t address these likely doubts, EV sales will almost certainly suffer.

Philip Junge

Global Director, Customer Engagement

The changes in consumer behavior and technology breakthroughs are creating a fundamental shift in the automotive customer journey. New insight from McKinsey & Co revealed that these changes are giving rise to disruptive technology-driven trends including alternative forms of mobility, autonomous driving, electrification and connectivity.

Digitalization, paired with an increasing end-customer affinity with e-commerce, has led to the emergence of new touchpoints throughout the customer lifecycle. By digitalizing their traditional business processes, OEMs and their dealer networks can engage and interact with their customers in many new ways.

As they do with most other retail experiences, consumers demand online platforms that enable product searches and comparisons, and ultimately enable them to finalize the buying decision online. Interestingly, so far the automotive industry has not adopted e-commerce to the level that other industries have achieved.

Rob van Rijswijk

Vice President, Product Management

The automotive industry is adjusting to a period of accelerated change. Increasing competition has already influenced the development and design of vehicles, and more in-car technology is being introduced with each new model. Meanwhile government regulations are dictating fuel efficiency and lower emissions, placing a greater focus on the development of electric vehicles.

Consumers want more from their buying journeys, from greater convenience to integrated, customized experiences. These demands are affecting the breadth of products and services offered by OEMs, who must step up to meet their expectations. Whether they’re managing service capacity, handling warranty claims or improving staff performance, retailers have to deliver the speed, quality and accuracy expected by their customers.

Heiner Prümper

Global Strategic Account Executive

Complex maintenance is among the most common concerns that affect the adoption of electric vehicles (EVs). But in reality, the intervals between each service on an EV remains roughly the same as with a regular vehicle, and the services themselves are usually far less complex. Regular vehicles contain hundreds of mechanical and moving parts, whereas an EV contains far fewer. The parts on an EV are also generally easier to replace and don’t wear out as quickly.

The only big “ potential“ cost when it comes to EV maintenance is replacing the battery. A battery may have lost up to 20% of its range by the time the vehicle reaches 100,000 miles. Some batteries have been designed in such a way that modules can be replaced, as opposed to the entire battery itself, however, this is highly dependent on the way the vehicle has been manufactured.

While a service on an EV can take significantly less time to perform, there are other differences in the service process which can have an impact on the aftersales business for an OEM.

Felix Serrano

Vice President Europe

Norway is, without question, the biggest success story to date when it comes to the transition to zero-emission transportation. The country has gradually introduced incentives since 1990 and has now set a target for 2025 – for 100% of vehicles sold to be ‘zero-emission’.

Around 40 years ago, Norway discovered it was sitting on one of the world largest oil reserves and has used this resource to boost the economy, making Norway the largest sovereign wealth fund in the world. This wealth plays a vital role in financing the e-mobility movement and has allowed the government to speed up the transition to zero-emission transportation by offering a wide range of incentives to those investing in e-mobility solutions.

Jayesh Jagasia

Global Executive Director

The evolution of the electric vehicle (EV) has profound implications on the way vehicles are serviced and the competencies technicians need to operate in an allelectric environment. There are five major factors that will affect how technical training will be designed and delivered in the age of EVs.

EVs currently represent a large financial and technological leap for consumers, whereas hybrid vehicles may be considered a more attainable compromise. Because of this, it’s likely that before the battery electric vehicle (BEV) comes of age, the industry will see a proliferation of hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs). While BEVs have far fewer components and are less complicated than internal combustion engine (ICE) vehicles, HEVs and PHEVs are more complex. This rise in hybrid vehicles will mean OEMs need to invest in more technical training to ensure dealership technicians can service and repair them.

Ronnie Xu

Head of Greater China

Sales in the Chinese electric vehicle (EV) market rose 78.3% year-on-year from 2017 to 2018. EVs are highly popular in China, and numbers are expected to grow even further by 2025.

China’s government has played a key role in the growing numbers of consumers buying EVs through the introduction of incentive schemes. These incentives vary by region but include tax deductions on EV purchases as well as free registration for new vehicles. The government has also offered incentives to OEMs in different regions to develop their charging infrastructures, including the installation of personal charging points in residential areas.

China’s EV push has, without doubt, attracted some big automotive players. Global OEMs are agreeing to source batteries in China, for example, and are even starting to think about using China as their lead market for EV development.

Andrea Sorrenti

Vice President, Americas

With electric vehicles (EVs) accounting for just 1.8% of the 17 million vehicles sold in the US in 2019, it seems America is adopting the transition to EV mobility at a much slower rate than other markets. A number of factors contribute to this:

Regulatory affairs – Several US states offer incentives for the purchase and operation of EVs, but the regulatory push towards electrification is still not enough to encourage a large number of consumers to make the jump.

Most US states charge drivers fuel taxes to fund infrastructure projects. To ensure EVs contribute, 26 states are also applying these fees to EV drivers. According to a study by Consumer Reports, EV fees in 11 out of the 26 states are higher than the fuel taxes that an equivalent internal combustion engine (ICE) vehicle pays every year. Another 10 states are in the process of introducing similar EV fees.

GLOBAL EDITION

Benchmarker

Thanks for reading our March 2020 Issue!

Editorial Team

Publisher: Pieter van Rosmalen, Chief Product Officer, pvanrosmalen@msxi-euro.com

Chief Editor: Jochen Schultze

Copywriting: Caroline Wiseman, Marsha Moore

Layout and Design: Julia Müller

Research: Ana Santos, Jade Murrell

Published by MSX International

Previous Editions:

Latest issue: Beyond Digital.

Forward Thinking Insights

(R)evolution of Retail:

Outlook 2025

Digital

Transformation